Overview

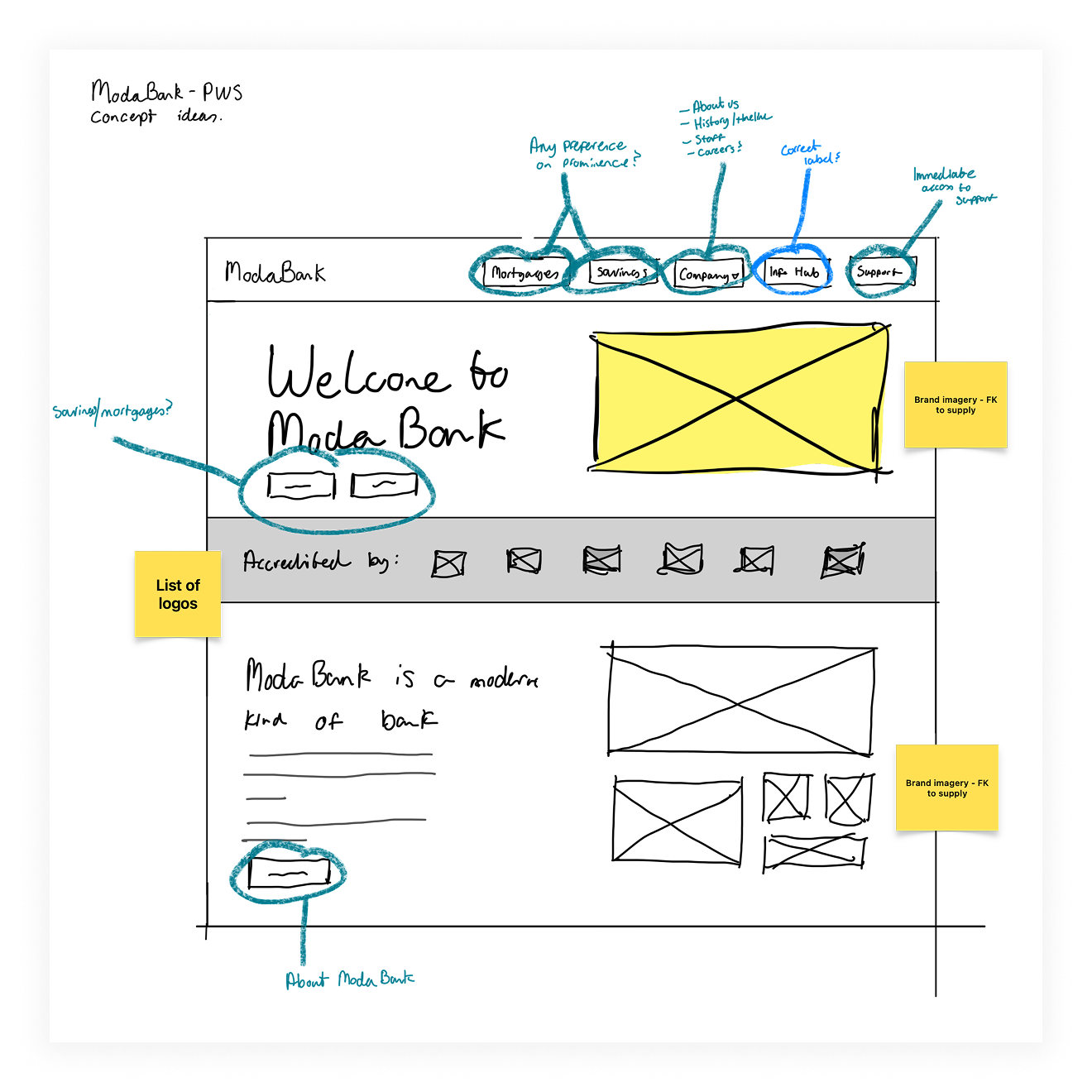

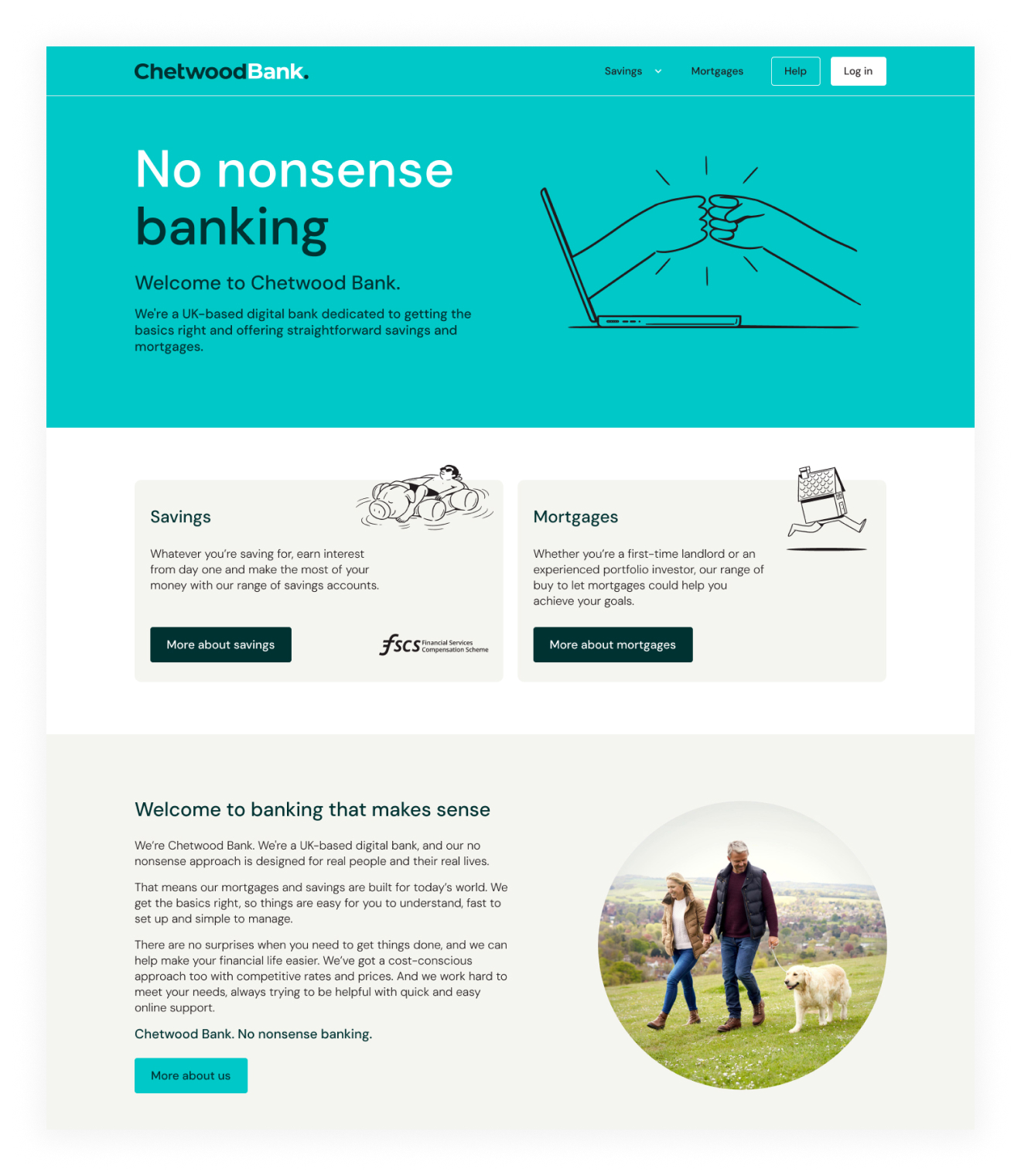

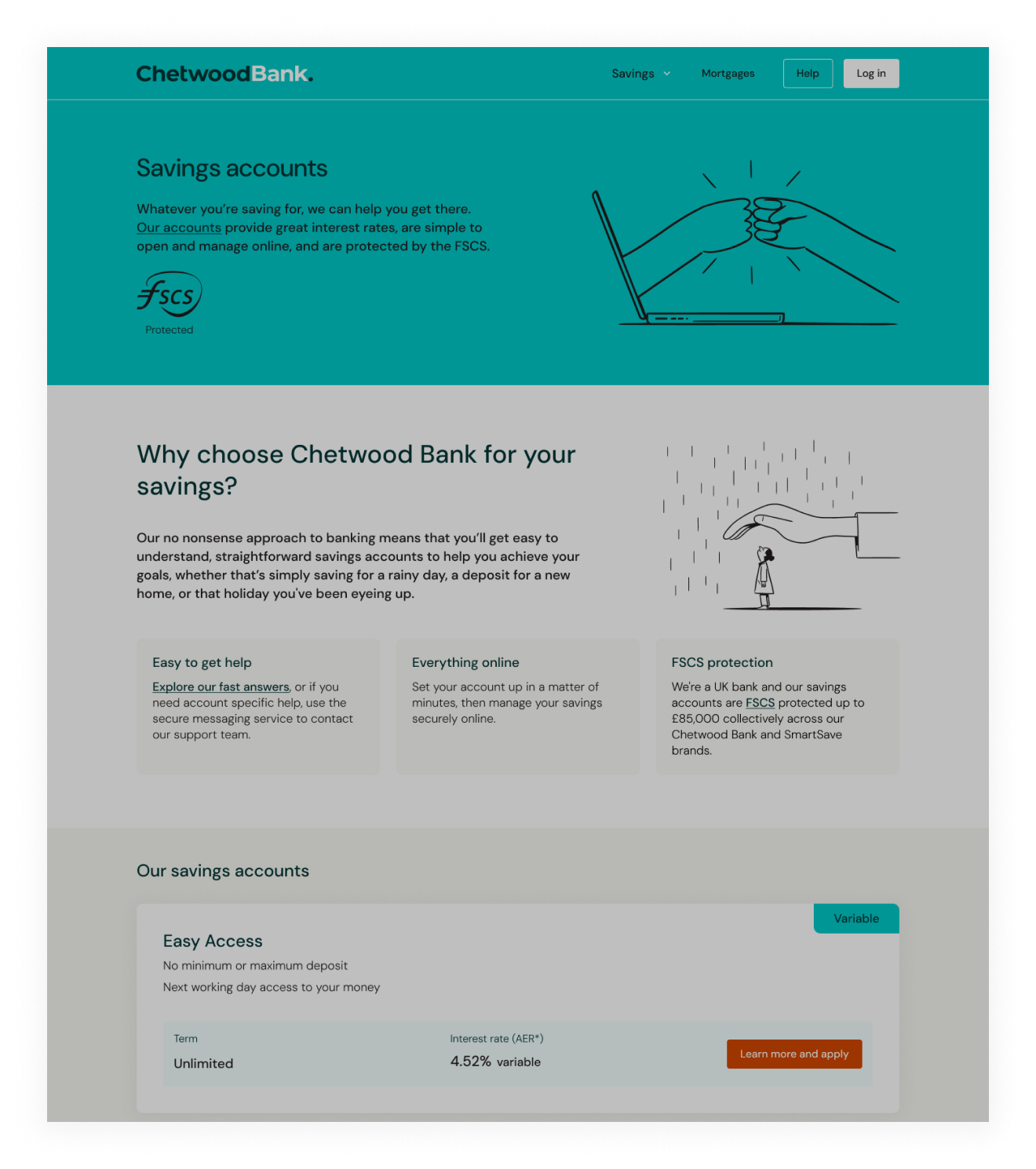

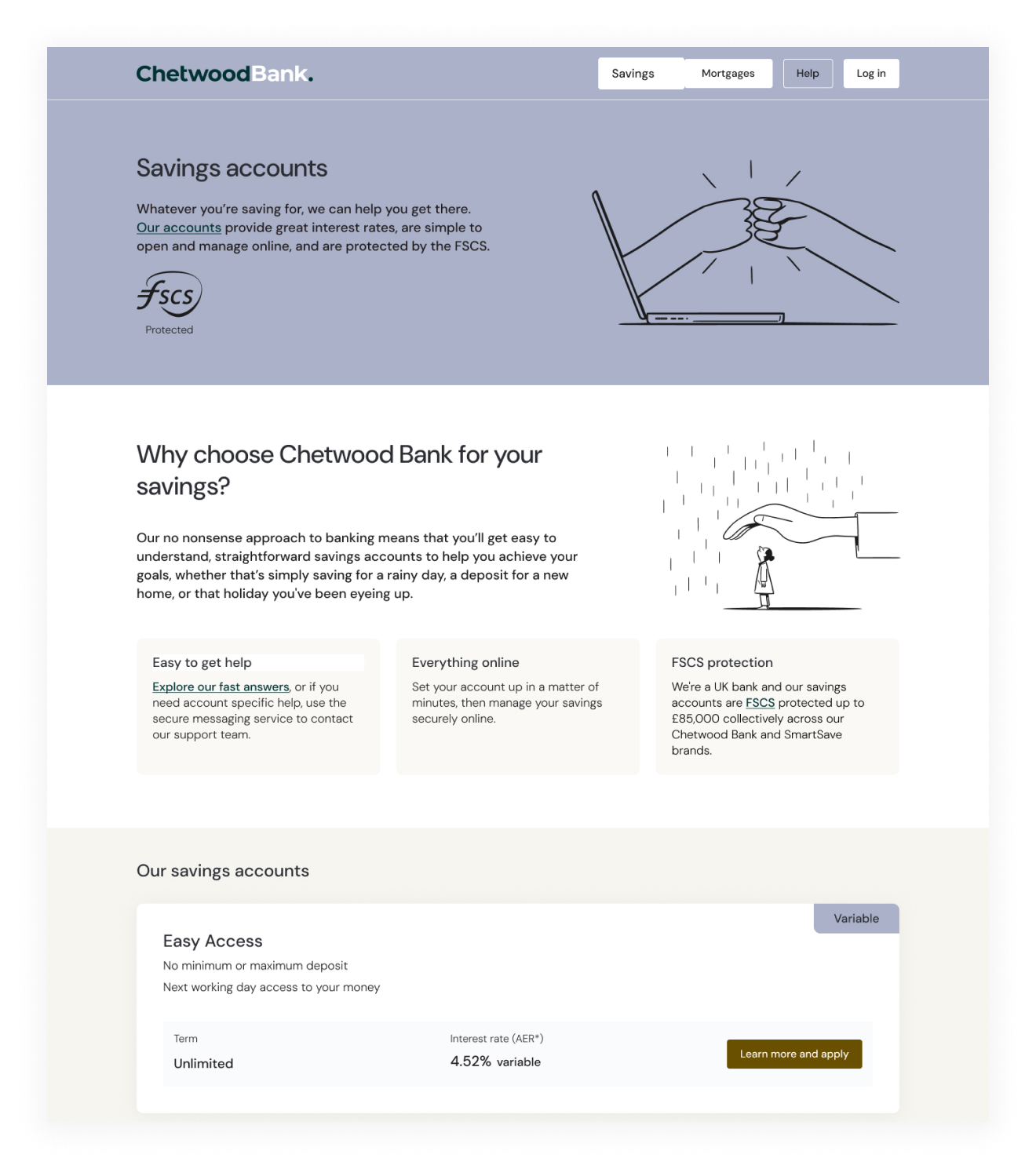

This project was all about helping Chetwood Financial step confidently into its next chapter as Chetwood Bank. It wasn’t just a new name or a fresh logo. This was a full rebrand that reflected the shift from a challenger financial provider to a fully authorised, trusted bank.

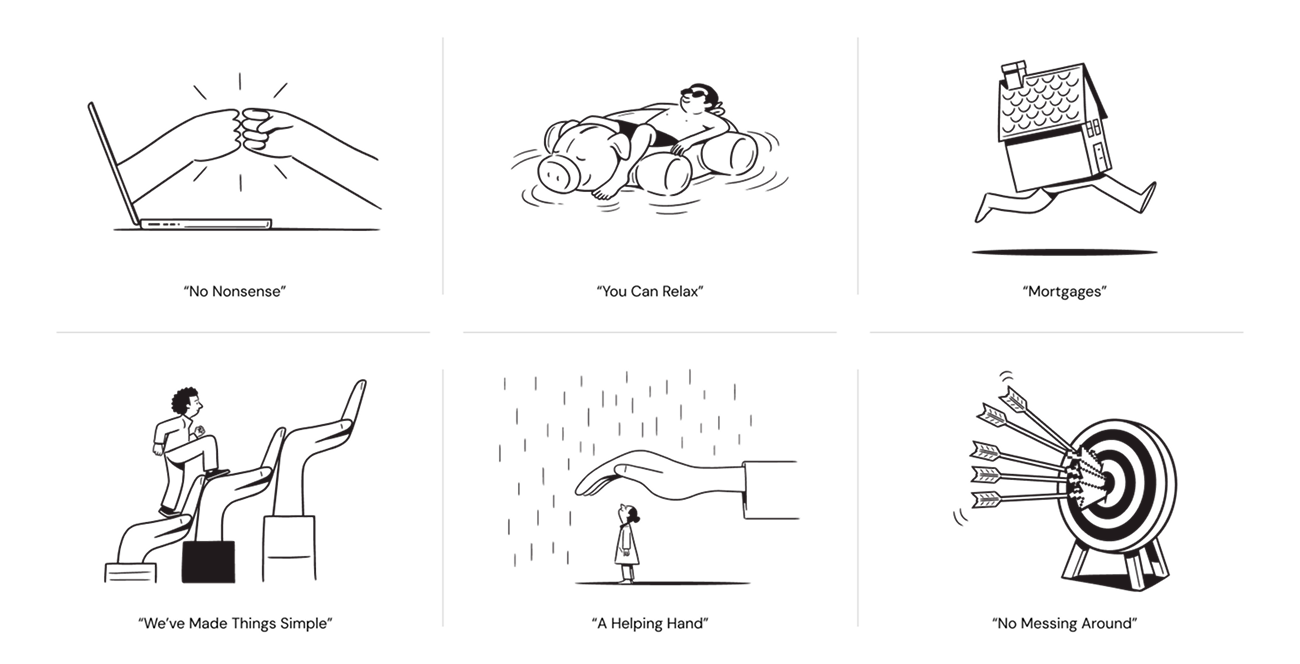

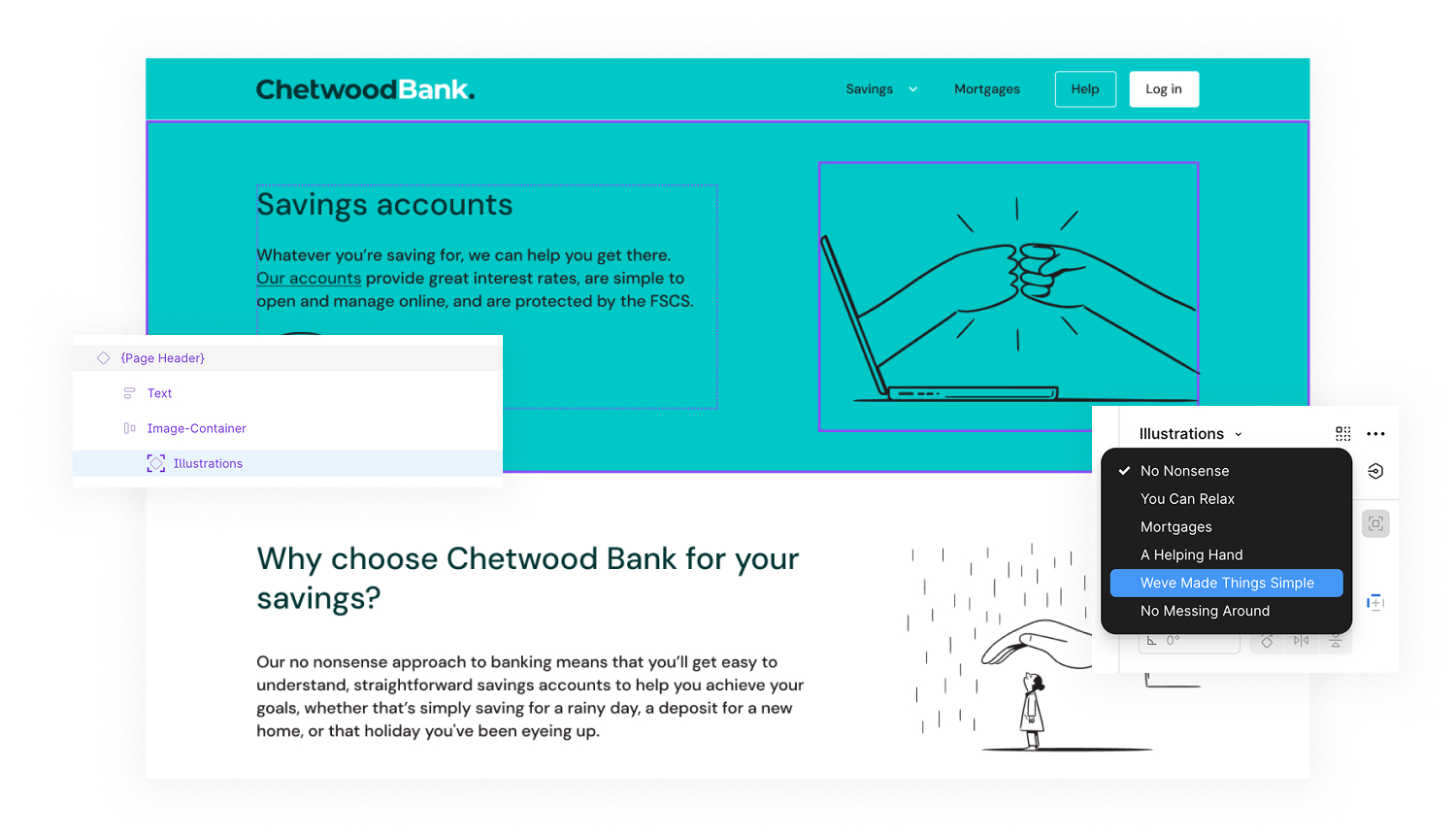

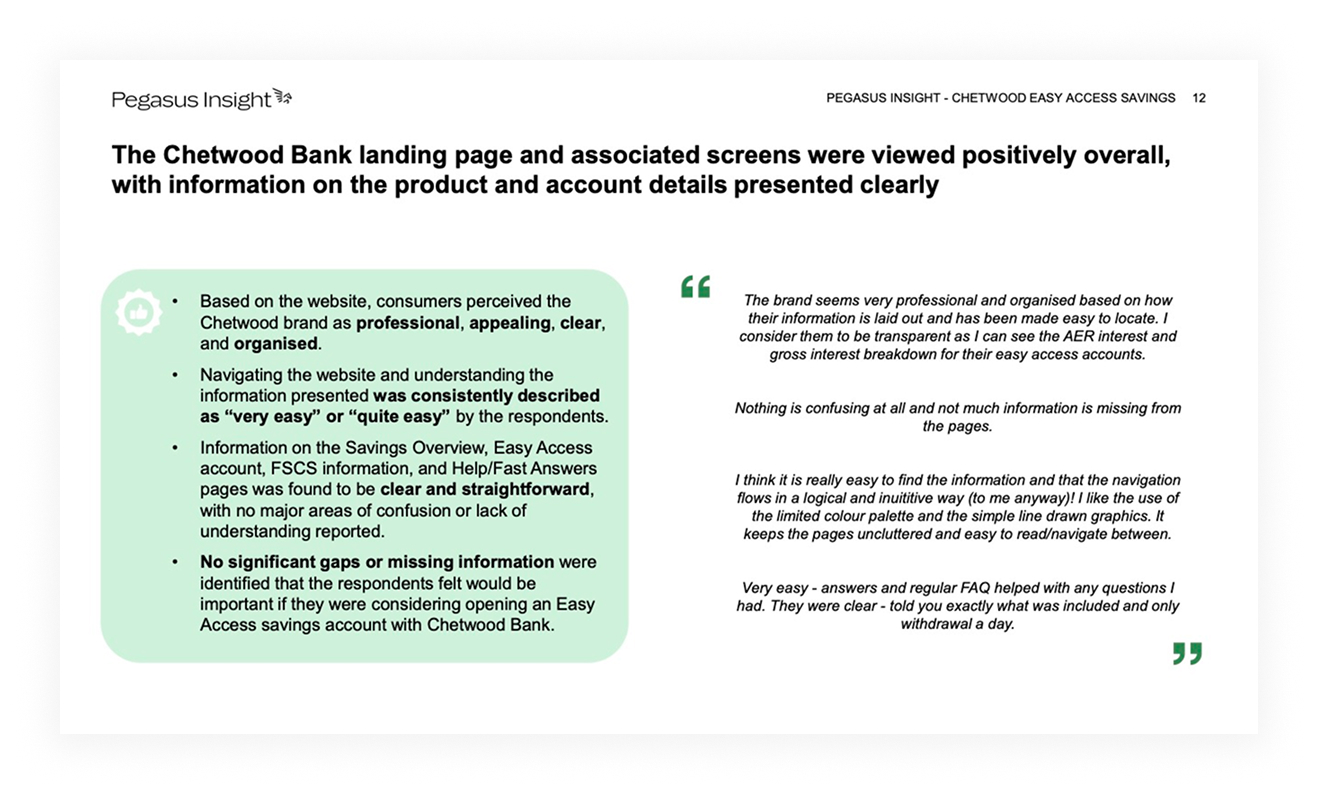

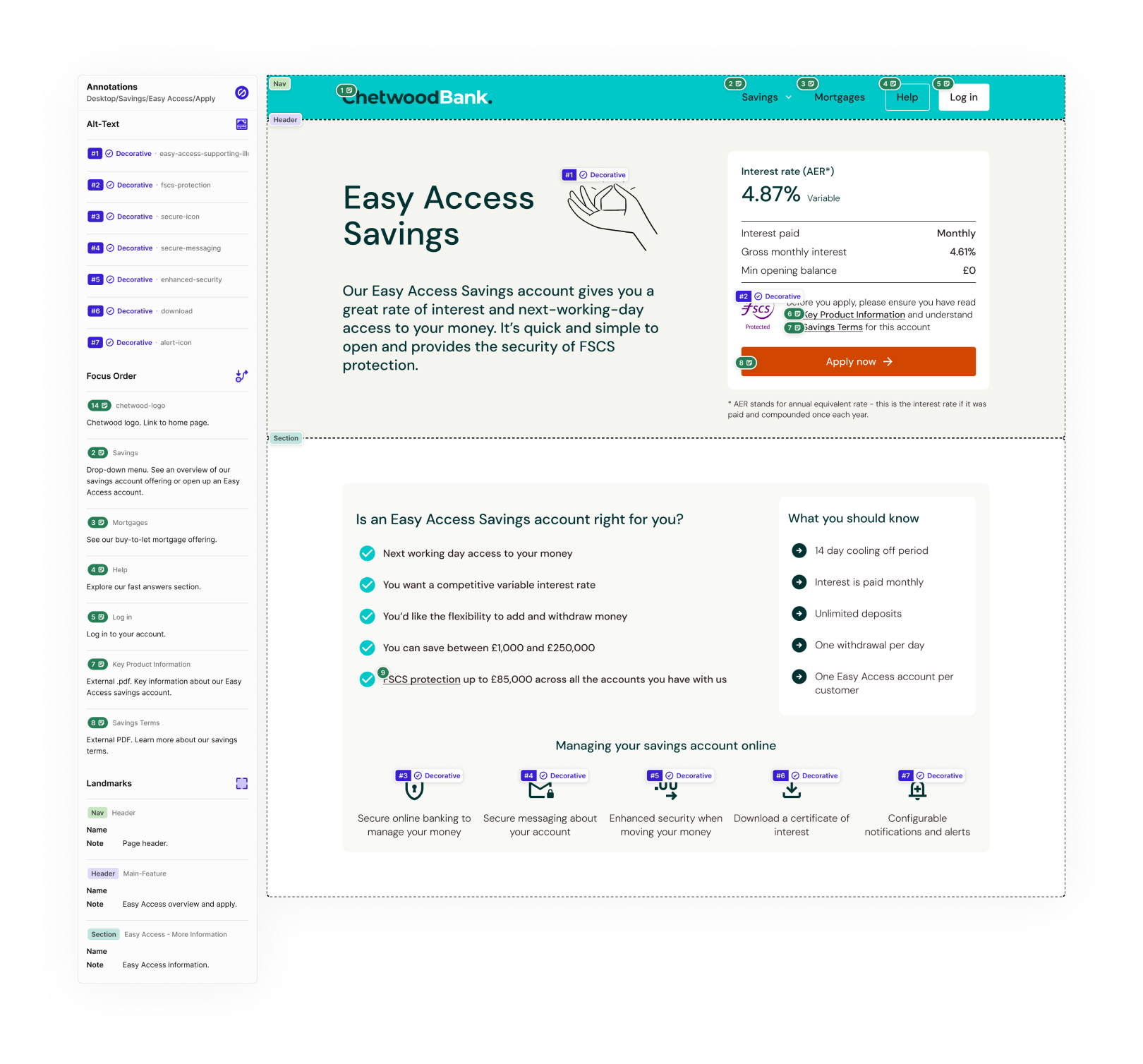

The rebrand itself was developed by an external agency, who provided us with a new colour palette, updated fonts and a refreshed brand direction. Alongside this rebrand, Chetwood was preparing to launch a new Easy Access savings product, making this a key moment to show customers what the new brand stood for.

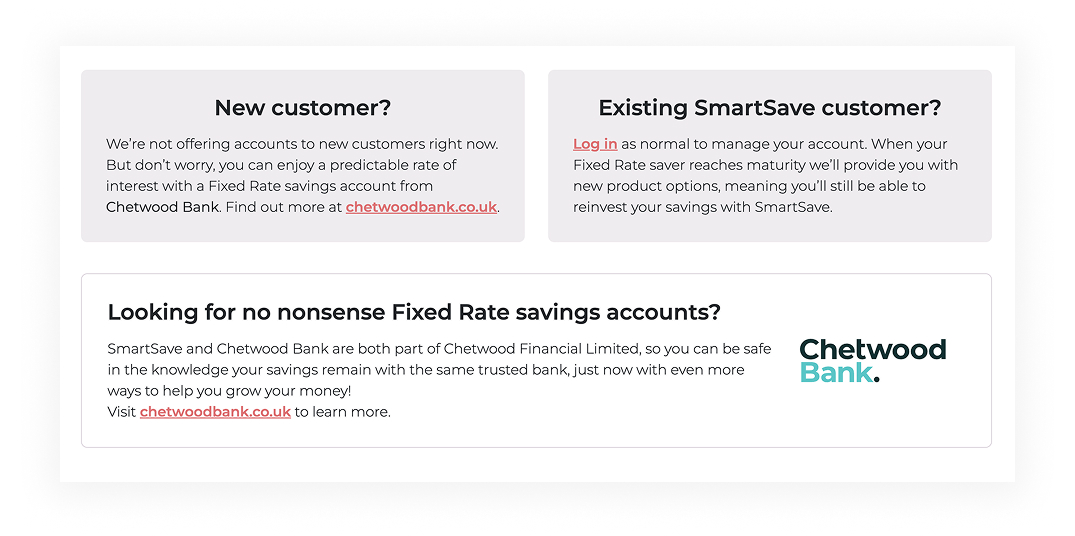

As part of the move to Chetwood Bank, the business also made the decision to stop accepting new customers across its other savings and lending brands. These products would continue to exist for current customers, but wouldn’t be actively promoted anymore. It was important that these brands were still acknowledged on the new website, with clear links and information to help existing customers get to the right places.

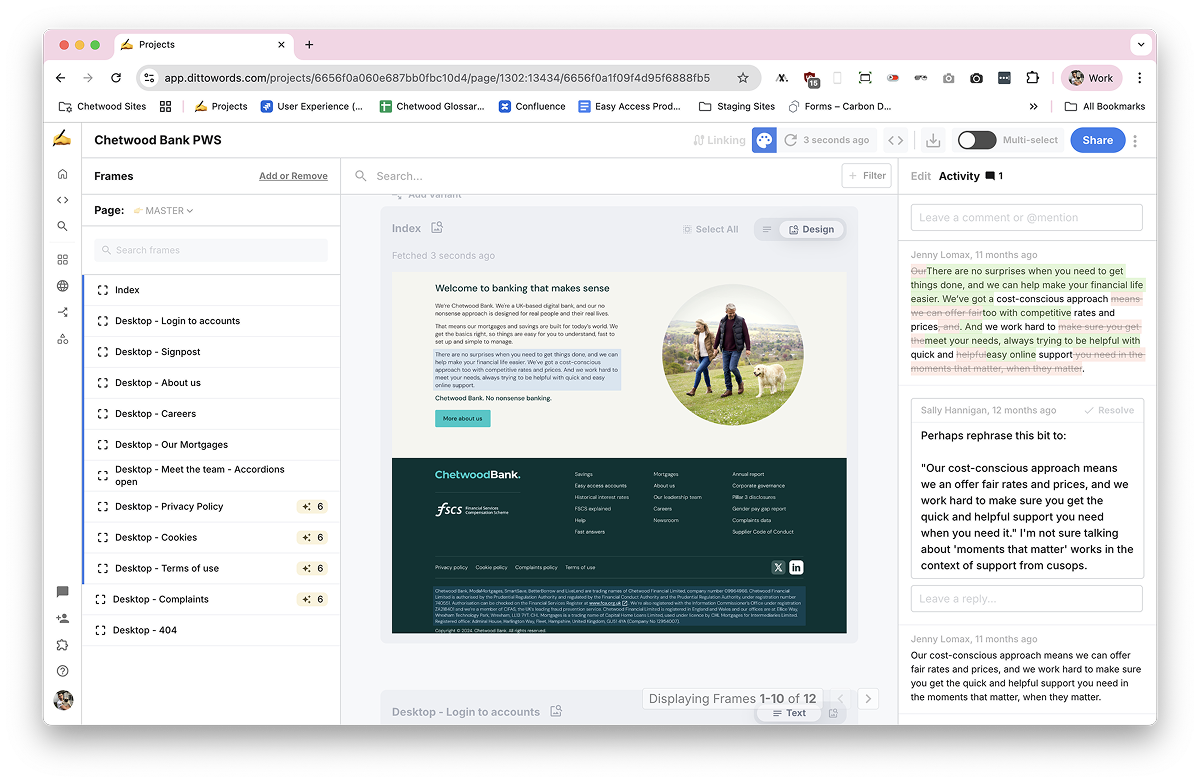

Our job as the UX team was to take all of this and make it meaningful in the product experience. We wanted the rebrand to feel more than just a new coat of paint. Every part of the journey, from landing on the website to opening an account, needed to feel clear, reassuring and aligned with this new direction.

Our audience

We knew this audience was already familiar with Chetwood as the name behind SmartSave, but Chetwood Bank itself would be new to them.

That meant we had to build trust quickly, show the value of the new accounts and make the transition feel seamless. Customers arriving from SmartSave needed to understand what was changing, why it was a good thing, and how they could get started without any hassle.

Show customers who we are, build immediate trust with the new brand, highlight FSCS protection, and guide them to open an Easy Access savings account.

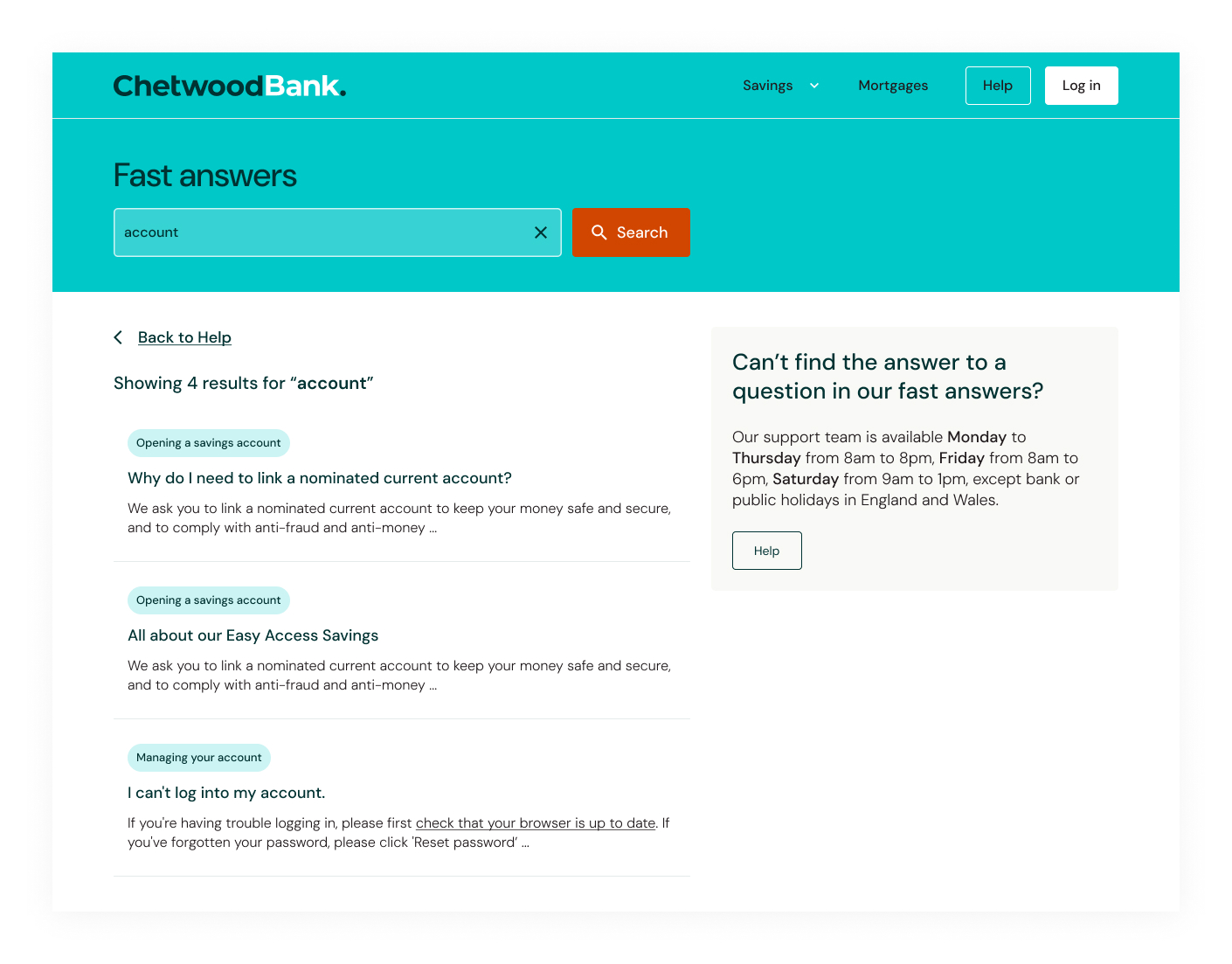

Give customers fast access to the support they need through our Fast Answers help section, with clear routes to get in touch by email, phone or live chat if they needed more help.

Provide an easy, signposted journey to the Sandstone platform so customers could log in and manage their savings.

Incremental updates

Since the Chetwood Bank website went live, we’ve continued to make regular updates and improvements as a UX team. Rather than treating the launch as the finish line, we’ve taken an incremental approach, refining and evolving the site based on feedback and changing business needs.

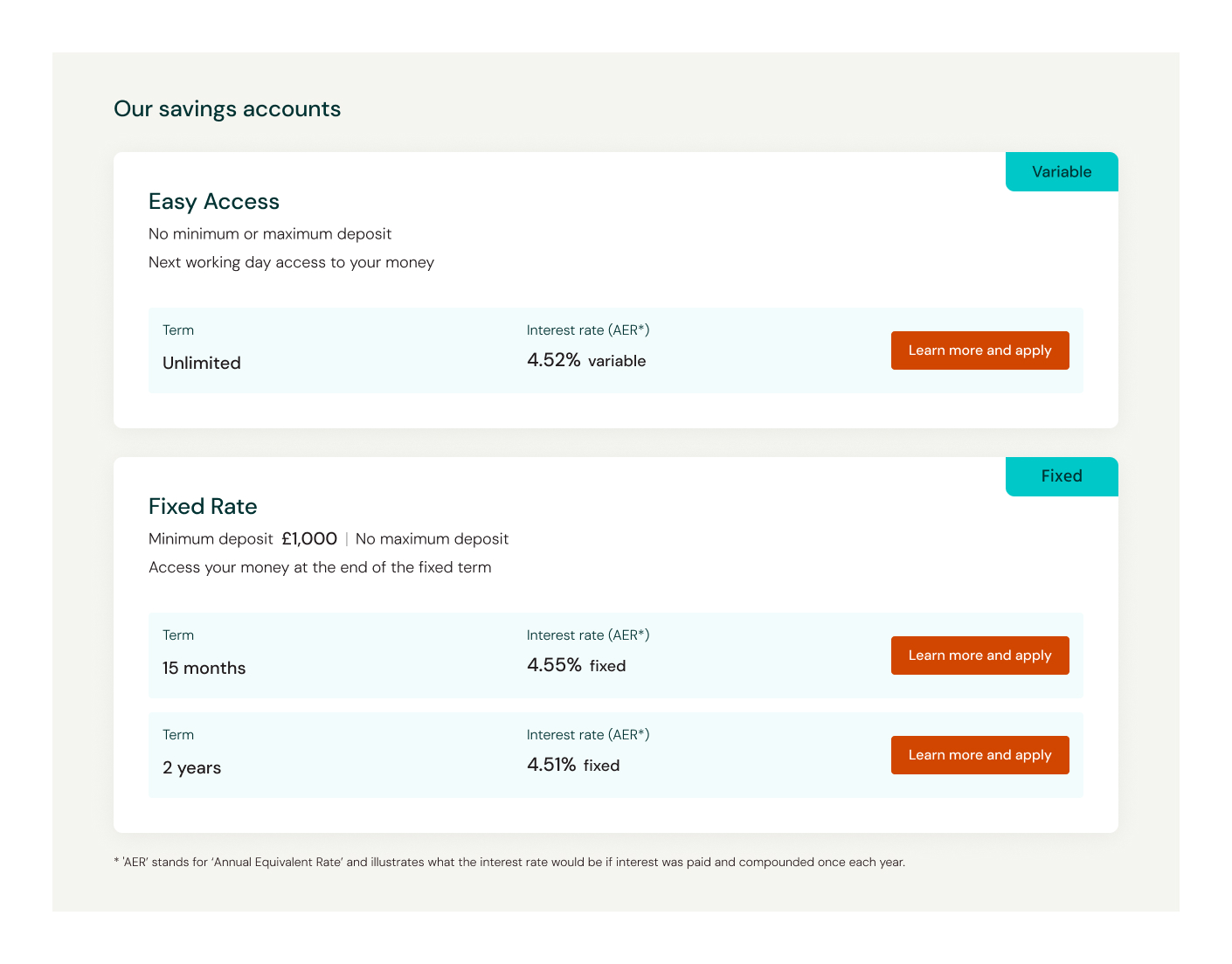

One of the major additions was the launch of a new range of Fixed Rate savings accounts, offering terms from 1 to 5 years.

This required updates to product pages, journeys and supporting content, which was made much easier as we designed the initial product card with this in mind.